5 Tips for Founders While Creating an Employee Participation Plan

Check out Maarten Graven's tips for startups creating their first ESOP!

Check out WE.VESTR co-Founder & CCO Maarten Graven’s tips for founders who want to create an employee participation plan.

Tip 1: Communicate Both the Percentage and the Number of Shares

Simplify the math for your employees and be clear about how many shares or options are included in employee grants, as well as the percentage. This resolves questions from employee participants, it also sets a standard of transparency.

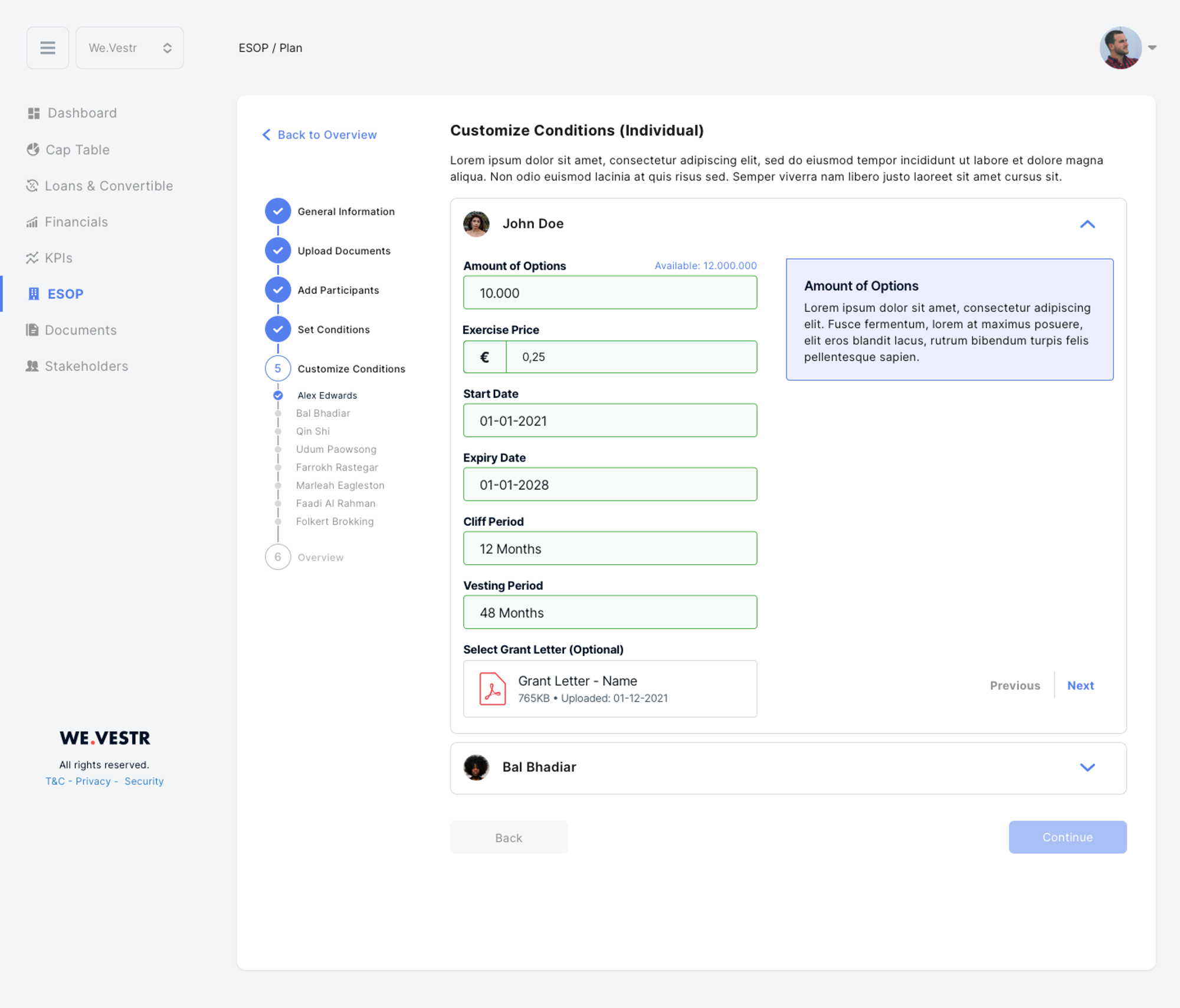

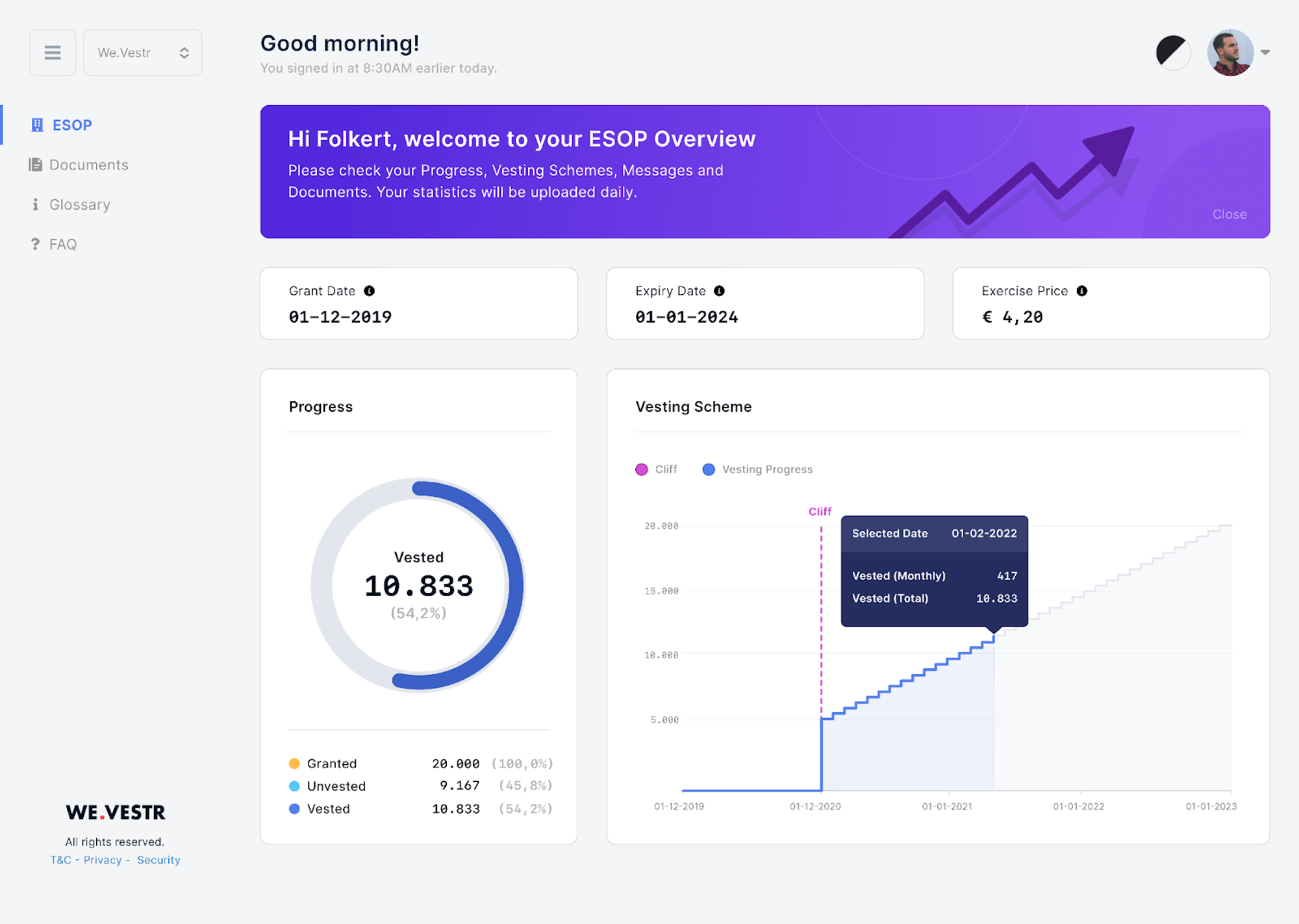

Tip 2: Use Live Reporting

Tools like WE.VESTR enable live reporting for all employee participants. Using such tools is a good ways to save loads of time in reporting on the company’s plan.

Tip 3: Learn With Your Team

Employee participation plans can be complicated, and there’s no shame in learning about them alongside your team! Resources for learning the basics of ESOPs are everywhere, but consider starting with a search around our Glossary of Terms and our Blog for foundational information.

Tip 4: Try a Heavy-Tail Scheme if You’re Focused on Retention

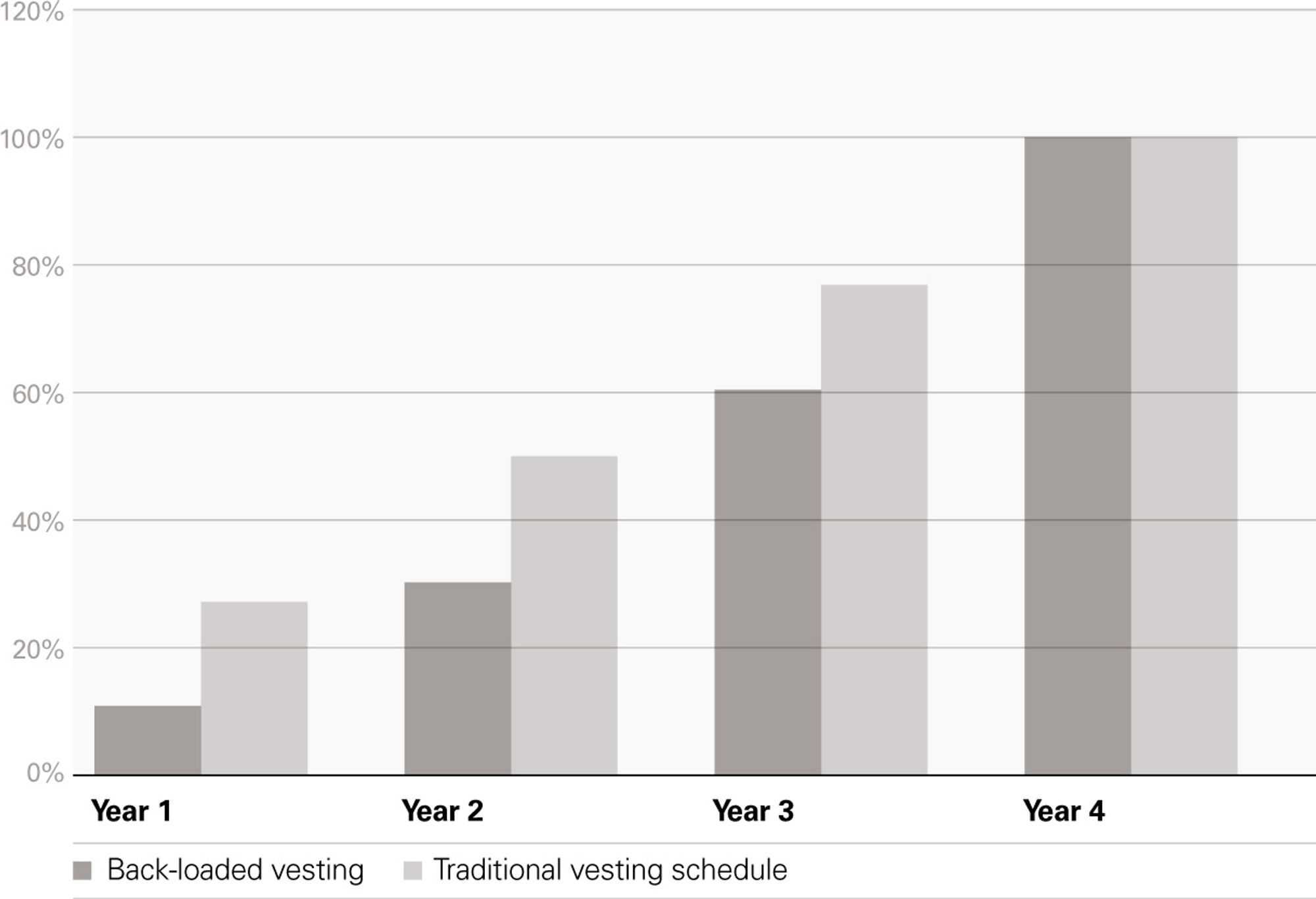

There are a number of traditional vesting schemes, and each can benefit different strategies. In a heavy tail/back-loaded vesting scheme, options and shares are vested at a slower pace in the first years, and then ramp up towards the end. This is advantageous for employee retention.

Back-loaded ESOP Vesting Schedules Can Help With Retention

Tip 5: Start Your ESOP Early

Some investors mandate ESOPs, or at minimum want to have confidence that founders are making plans to start one. Also, starting an ESOP late in the game can result in a higher impact of dilution for your shareholders. Therefore, starting early only helps founders as they scale their companies.

Learn more about setting up your WE.VESTR account here.